Arthur Hayes: Trump Tariffs Good For Bitcoin As Governments Print Money To Offset Pain

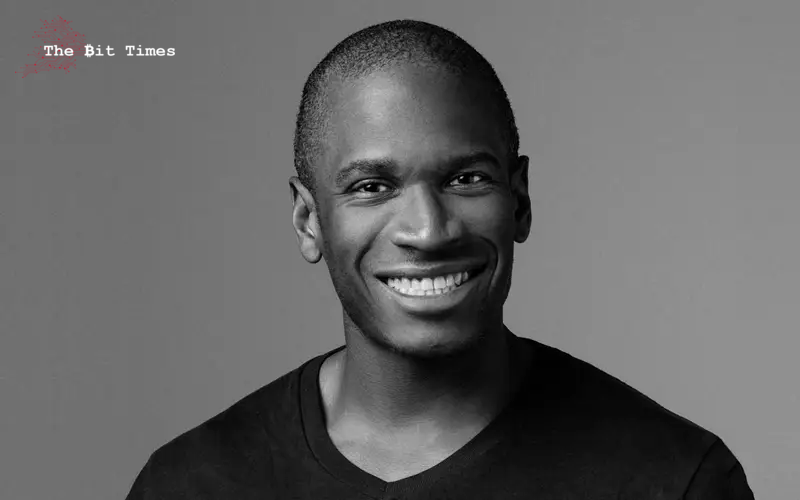

BitMEX co-founder Arthur Hayes says that Donald Trump’s tariffs are good for Bitcoin (BTC) because the government will offset the economic pain they cause by printing money.

“Some of y’all are running scurred, but I LOVE TARIFFS,” he said in an April 3 thread on X. ”Global imbalances will be corrected, and the pain papered over with printed money, which is good for $BTC.”

Arthur Hayes Tells Traders And Investors To Be Patient

Investors just need to be patient, said Hayes, as governments across the globe start to print more money, subsequently introducing more liquidity that could flow into the crypto market.

The BitMEX co-founder noted that the US dollar is weakening while offshore investors sell US tech stocks. He believes that this could benefit BTC and gold over the medium term.

The $ is weakening alongside foreigners selling US tech stocks and bringing money home. This is good for $BTC and gold over medium term. pic.twitter.com/XzRcxOaJzT

— Arthur Hayes (@CryptoHayes) April 4, 2025

Hayes also said that the 2-year treasury yield is being dumped after Trump’s tariff announcements. He said the US Federal Reserve (Fed) will start to cut interest rates and restart quantitative easing (QE) soon to counter the declining yield.

That would put downward pressure on the dollar, and potentially enhance Bitcoin’s status as a store of value and as an investment that can’t be manipulated by government policy.

Risk Assets Could Fly Through The Roof, Says Bitwise Analyst

The BitMEX co-founder’s comments come after the Trump Administration announced far-reaching tariffs on nearly all US trading partners on Wednesday.

In addition to a 10% baseline tariff on imports from all countries, the administration also imposed a 34% tax on imports from China and 20% on the European Union, among others.

While several analysts have stepped forward and said the tariffs could lead to a global recession, some agree with Hayes that the new tariffs could be good for Bitcoin.

This is the only thing you need to read about tariffs to understand Bitcoin for 2025. This is undoubtedly my highest conviction macro trade for the year: Plaza Accord 2.0 is coming.

Bookmark this and revisit as the financial war unravels sending Bitcoin violently higher. pic.twitter.com/WxMB36Yv8o

— Jeff Park (@dgt10011) February 2, 2025

On Feb. 3, head of alpha strategies at Bitwise Invest, Jeff Park, said that a weaker dollar and weaker US rates could send risk assets “through the roof” beyond investors’ wildest imagination.

He added that a potential financial war could send Bitcoin “violently higher.”

Related Articles:

- USDC Issuer Circle Files For IPO As Analysts Raise Concerns

- BlackRock CEO Warns Bitcoin Could Undermine Dollar’s Dominance

- Solana’s DEX Jupiter Acquires DRiP Haus To Offer NFT Trading

Comments

Post a Comment