AI builds the ideal crypto portfolio for 2024

Artificial intelligence (AI) tools have been proven useful for tasks that require gathering and consolidating data, despite being fallible. Finbold then turned to three advanced AIs and asked them to build the ideal crypto portfolio for 2024.

For that, we used OpenAI’s ChatGPT-4 Turbo, Antrhopic’s Claude 3 Opus, and xAI’s Grok. Additionally, we asked them to illustrate the portfolio allocations considering a $10,000 initial investment.

Interestingly, there are notable similarities in the three proposed crypto portfolios among some differences in the picks and correspondent weights.

Picks for you

Notably, all three have Bitcoin (BTC) and Ethereum (ETH) as the two largest positions in an ideal crypto portfolio. Bitcoin weighs 40%, or $4,000 for a $10,000 net worth cryptocurrency investor, in all three AIs. Meanwhile, ChatGPT and Grok allocate $3,000 (30%) in Ethereum, while Claude makes it a $2,500 (25%) investment.

Moreover, the three consulted AIs included Solana (SOL), Chainlink (LINK), and Polkadot (DOT) with varying shares of the crypto portfolio.

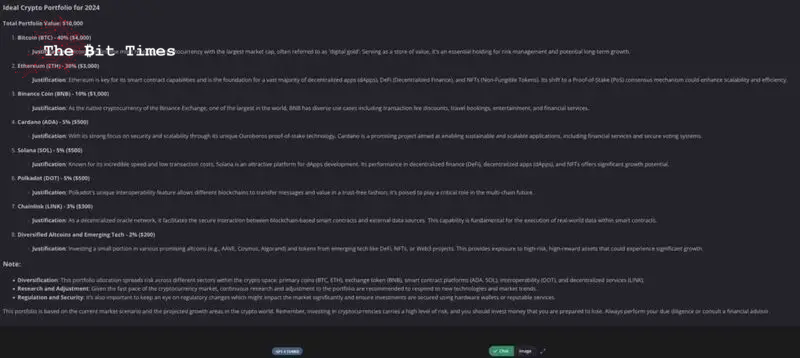

ChatGPT-4 ideal $10,000 crypto portfolio

In particular, ChatGPT-4’s ideal crypto portfolio is made of eight allocations and focuses on diversification. The AI also highlights the importance of constant “Research and Adjustment” to follow the fast pace of the cryptocurrency market.

Binance coin (BNB) features as the third pick with a $1,000 (10%) investment, followed by Cardano (ADA) Solana, and Polkadot; each with $500 (5%). Finally, a $300 (3%) investment in Chainlink and a $200 (2%) diversified allocation in other altcoins and emerging tech.

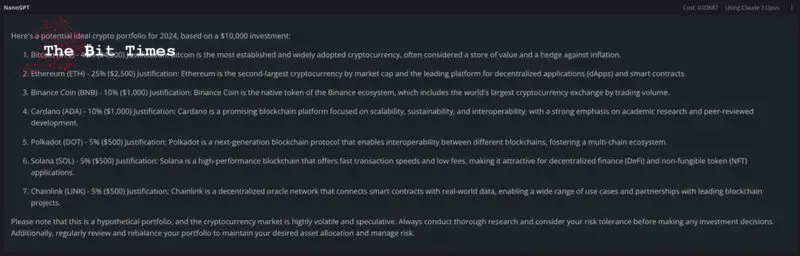

Claude 3 Opus’s best crypto portfolio

Similarly, Claude 3 Opus picks BNB and ADA as the third and fourth largest cryptocurrencies. The resemblance to ChatGPT’s crypto portfolio continues with DOT, SOL, and LINK, in order.

However, Cardano has a 10% weight in Claude’s portfolio, while Chainlink goes with 5% and no smaller diversifications.

This AI also notes the importance of thorough research and mentions investors must consider their risk tolerance when making decisions.

Grok AI’s crypto portfolio allocation example

Next, the AI developed by Elon Musk’s X enterprise, Grok, removes BNB and Cardano, while adding Uniswap (UNI) last.

Grok also invests double the other two on Chainlink and Polkadot, for a $1,000 (10%) allocation. Solana has the same weight of $500 (5%) in all three artificial intelligence tools, being Grok’s fifth pick. The decentralized exchange, Uniswap, is the only investment that is not a chain, but a protocol built on other chains. Receiving a $500 (5%) purchase.

In closing, xAI’s chatbot concludes its crypto portfolio is focused on cryptocurrencies with strong fundamentals, active development, and real-world use cases. Previously, Elon Musk’s AI named the ideal cryptocurrency for payments on X.

All things considered, these guidances should not be the only source of information to build the best 2024 investment strategy.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment